Solo

Investment fund

Mibiton Solo gives young Life Sciences organisations with (the prospect of) a turnover or a first round of funding the opportunity to invest in R&D equipment or facilities for an target amount of up to € 500,000.

Financial lease

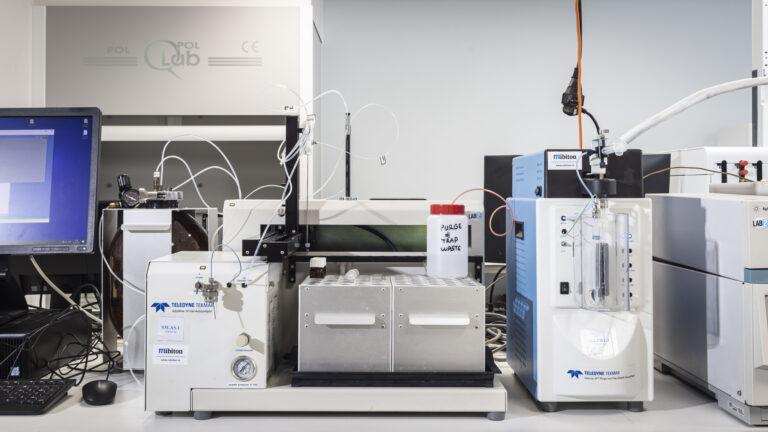

These are investments in, for example, laboratory equipment, a clean room or (medical or agro-food) equipment that has been developed by the company.

We offer an investment (financial lease) that must be redeemed within four years, including a market-based interest on the outstanding amount. After one year, you can (partially) repay the outstanding financing early without penalty. We can agree on a grace period of up to one year if required for the cash flow of your company.

Conditions and Benefits

Applications will only be processed if the following conditions are met:

- The fund is open to organisations engaged in Life Sciences, such as biomedical sciences, chemistry, food, agro or environmental technology.

- The fund is primarily intended for SMEs, although we do not necessarily exclude foundations.

- The applicant is able to demonstrate that it has sufficient cash flow to finance its other operational activities for a period of at least 1,5 to 2 years. For example, because the organisation has concluded a first customer contract or has (nearly) accomplished a funding round for operational costs (at least a signed term sheet should be available).

- Organisations that are already leasing equipment commercially and need to use additional equipment for a relatively high-risk R&D investment can also apply.

- The fund is open to start-ups that have closed a first round of financing with another (venture capital) investor. At least a signed term sheet should be available.

- The fund is not intended for starters who are at the very beginning of a development path. They are better off making use of Early Stage Funding, such as RVO (state agency for entrepreneurs in the Netherlands) or NWO (the Dutch organisation for scientific research). The fund is neither intended to finance R&D costs.

Even if you meet the above conditions, the application will ultimately be assessed by the board and the final decision will be made during the board meeting.

What is the procedure of the application?

We will go through the steps with you.

Quickscan

First please request for a Quickscan-form at mrs Anne-Marie Boers (boers@mibiton.nl). We will then check whether the application fullfills the basic fund criteria. After a positive assessment, we will send you an invitation for an online introductory interview.

Introduction

During the online introductory interview, we discuss the intended investment, conditions and procedure. This is followed by a positive or negative assessment.

Request

After the intake interview, we will decide whether the application is feasible. You and the Investment manager will draw up a complete application. This will be made up of a power point-business plan and financial information, including a solid cash-flow forecast. During the process, the investment manager will visit your company and perfroms the Due Diligence research. No later than two weeks before the board meeting, all documents should be available electronically (see Calendar).

Board meeting

During the board meeting, you will be asked to explain the application verbally and the board members will ask questions. The board assesses the application, after which the final decision is made.

Decision

Within two weeks after the board meeting, you will receive the decision in writing. One of the following four decisions will be given: (a) unconditional award;

(b) award under specified conditions; (c) rejection, however, with the possibility to reapply if you meet specific conditions; (d) unconditional rejection, no second chance.

We will treat the investment application as confidential during all stages. A confidentiality statement is available upon request. The investment application procedure takes a maximum of two months.

Progress monitoring

Upon approval of the grant, a lease agreement will be drawn up and we request a liquidity forecast every quarter. Every year, your company must issue a report with financial data and information about the use of the equipment or facilities. The investment manager will visit your company annually and report to the Board. If the term of the financing needs to be extended, this will be negotiable.

End of repayment

After payment, legal ownership of the equipment or facility is transferred for a small fee.